“War tax” on Russian LNG is key to starving Kremlin’s war chest

With the Russo-Ukrainian War in its third year, the international community faces a critical challenge: how to effectively counter Russia’s ongoing aggression while supporting Ukraine’s defense efforts. Despite numerous sanctions and diplomatic initiatives, Russia continues to finance its war machine through substantial fossil fuel exports, particularly liquefied natural gas (LNG) sales to European countries.

In response to this persistent issue, experts from the International Center for Ukrainian Victory (ICUV) have conducted research on the potential of a so-called “war tax” on Russian LNG imports to the European Union. This measure aims to strike a balance between maintaining Europe’s energy security and reducing the financial resources available to the Russian war effort.

This article explores the current state of Russia’s war economy, its ongoing energy exports to Europe, and the potential impact of implementing a war tax on Russian LNG.

Key points:

- By relying on its larger economy and population, Russia is able to continue its war against Ukraine.

- The Kremlin has shifted to a war economy, significantly increasing military spending.

- Despite sanctions, Russia still earns substantial revenue from fossil fuel exports, particularly LNG.

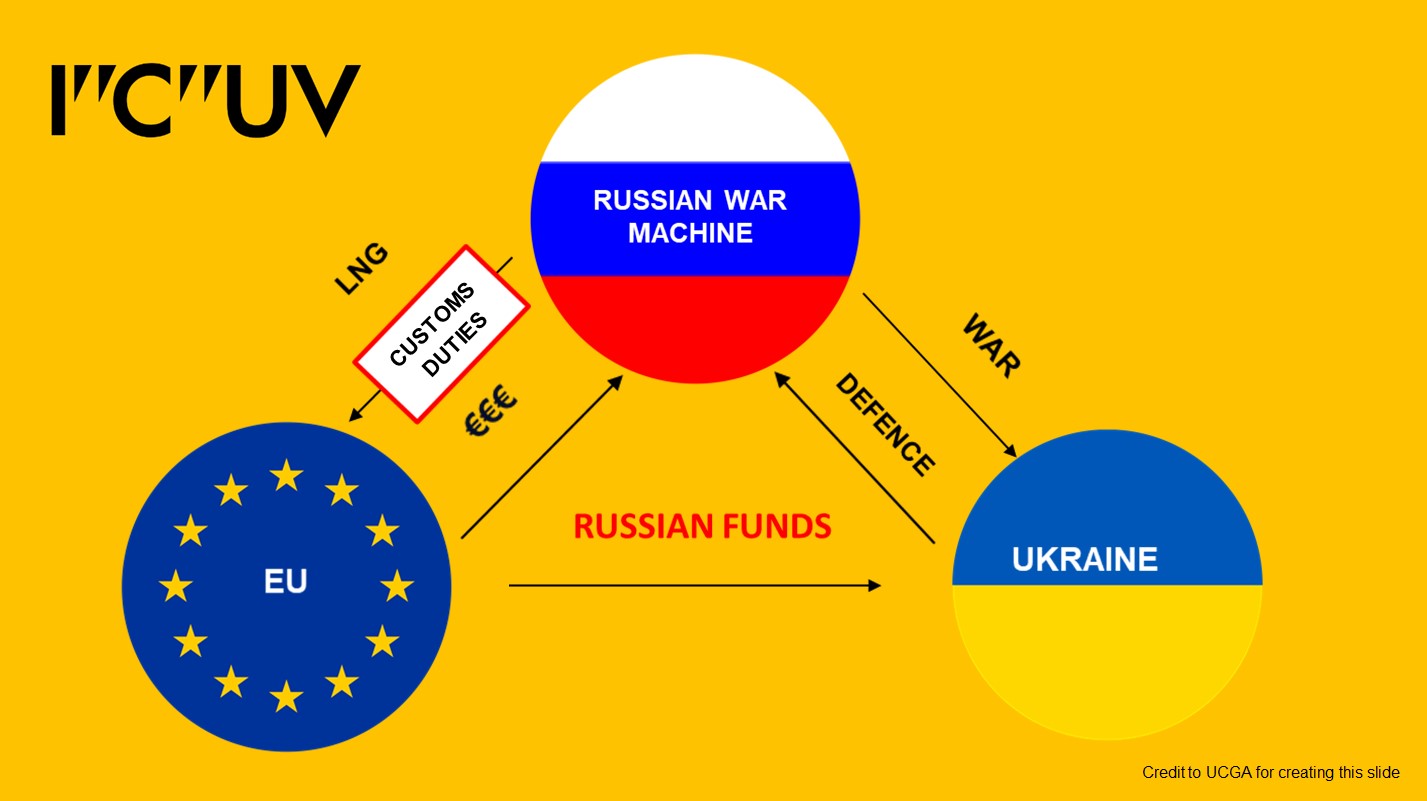

- The EU remains a significant consumer of Russian LNG, indirectly funding Russia’s war efforts.

- A proposed “war tax” on Russian LNG imports to the EU could limit Russia’s profits and support Ukraine.

- The war tax would be implemented as a customs duty, with proceeds allocated to aid Ukraine.

- This measure is seen as an intermediary step before a potential full ban on Russian energy imports.

”All for the front, all for victory”

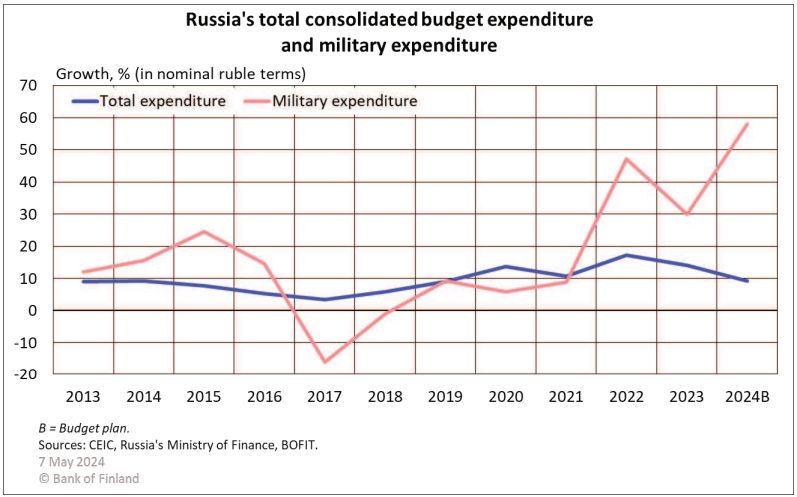

Russia has significantly increased its military spending under the slogan “all for the front, all for victory.” As a share of GDP, Russian military spending amounted to 3.61% in 2021, rising to 4.69% and 5.86% in 2022-2023, respectively, and 7.89% in 2024. It is clear that initially, Russia placed its bet on conquering Ukraine by blitzkrieg (quick or “lightning” warfare), seeing no need to prepare for a protracted war.

It is estimated that Russia’s “defense” spending will increase by 29% in 2024, with total security-related spending, including internal security, reaching about 40–45% of all state expenditures in 2024.

According to estimates by Pentagon officials, between February 2022 and February 2024, Russia spent up to $211 billion on its war against Ukraine.

Bank of Finland experts believe that Russia’s security-related spending growth in 2024 is expected to outpace overall spending growth by an even larger margin as government funds continue to be redirected toward supporting the invasion of Ukraine. Military spending has soared, with the Bank of Finland estimating a 60% increase in the production of weapons and ammunition in 2024.

In addition, the Russian government wants to earmark 32.5% of its military spending in 2025, a record amount and up from a reported 28.3% this year.

The Russian government’s draft budget released on 30 September proposes spending just under 13.5 trillion rubles (over $145 billion) on national “defense” in 2025. That is about three trillion rubles ($32 billion) more than was set aside for military spending in 2024, the previous record.

Russia continues to invest heavily in war-related industries, including the building of infrastructure supporting the war effort in bordering regions, military production hubs, and repair facilities. Other industries contributing to manufacturing investment growth in 2023, such as the production of chemical products and base metals, can also support the war effort.

In contrast, the USA’s and EU’s military aid to Ukraine is smaller, standing at $149 bn between January 2022 and April 2024. While significant, it is insufficient to give Ukraine an edge in materiel.

Furthermore, the EU continues to fund Russia’s military expenditures. Despite its desire to reduce its dependence on Russian gas, the European Union is replacing sanctioned Russian pipeline gas with LNG, with over 10% of pipeline volumes replaced already.

The hidden cost of European energy

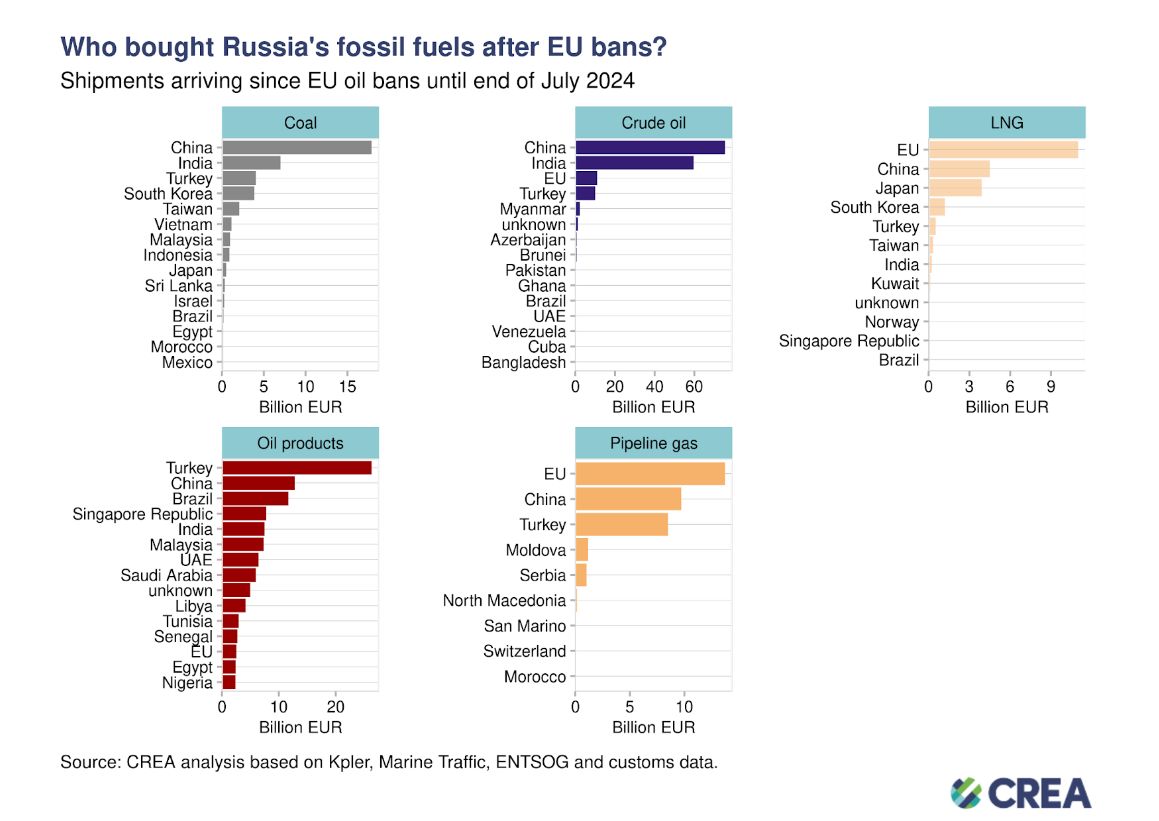

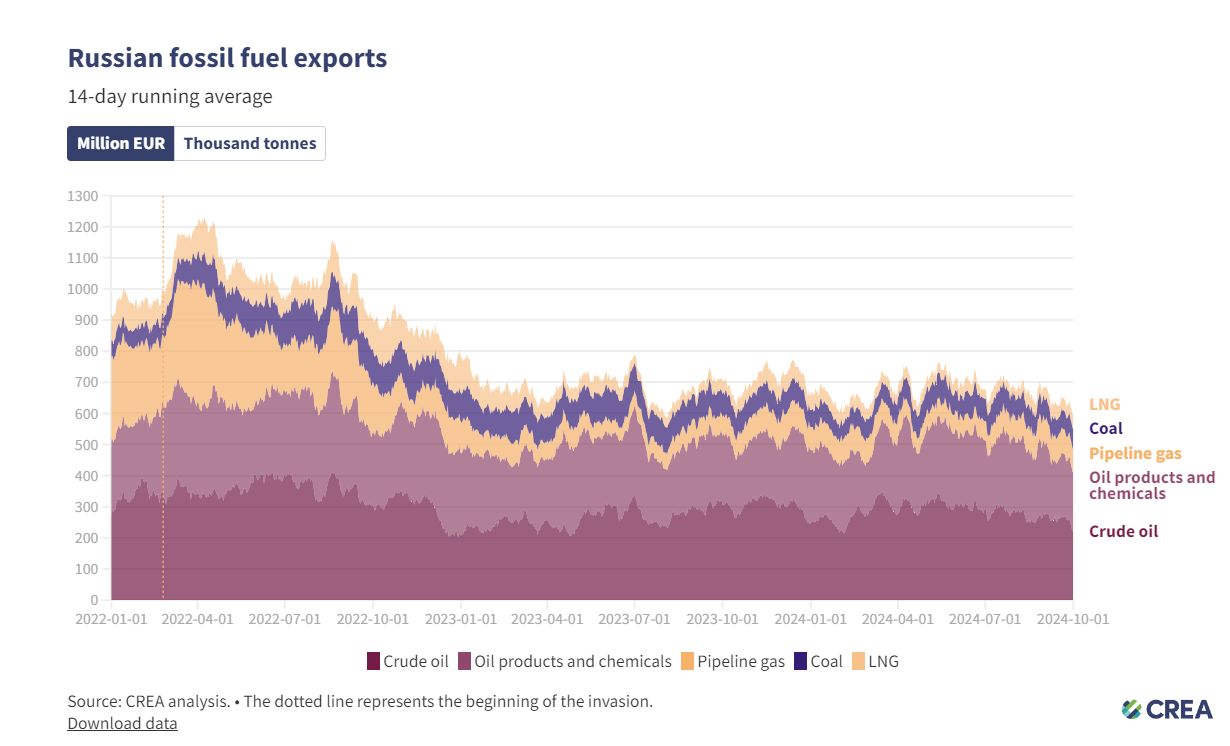

Oil and gas have been the primary sources of revenue for the Russian budget. Despite some Western sanctions against Russian fossil fuel, e.g., oil price cap and a decrease in consumption of Russian gas in Europe, Russia is still able to earn money by selling pipeline and LNG gas, crude oil and oil products, as well as coal, bypassing the sanctions and increasing supplies to new markets such as China and India.

Since February 2022, Russia has continued making oil and gas profits, earning in total approximately EUR 742 billion. Over the same period, Western partners have imposed various sanctions to limit Russia’s access to the European energy market and reduce its hydrocarbon revenues, which made Russia refocus its exports to non-Western markets.

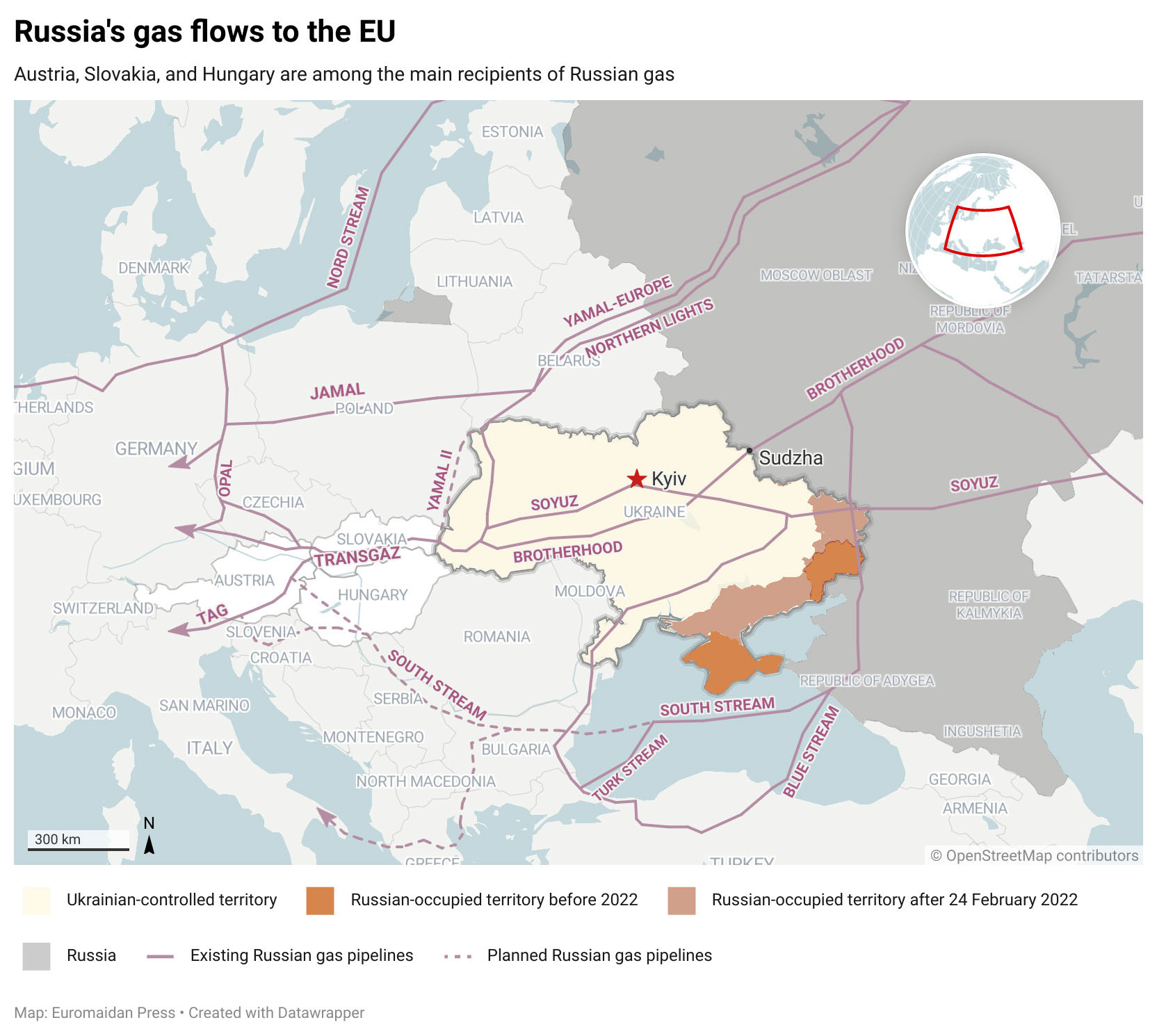

Despite the fact that Russia gets its largest fossil fuel profits from selling crude oil and oil products, the EU remains the top consumer of Russian pipeline gas and LNG, with the latter supplies even increasing. This risks placing European energy security back into dependence on Russia, as well as continuing to contribute financially to the Russian war machine.

While the EU has significantly reduced its dependence on Russian pipeline gas by halting gas exports through the Nord Stream 1 Baltic Sea pipeline and the Polish Yamal pipeline, some of these volumes have been replaced by increased LNG exports by ship. In addition, Russian gas continues flowing through the TurkStream pipeline to Türkiye.

In the first quarter of 2021, 47% of Europe’s total gas supply came from Russia, with 43% via pipeline and 4% as LNG. In the first quarter of 2023, Europe still imported 14.8% of its total gas supply from Russia, with 8.7% arriving via pipelines (25.1 billion cubic meters or bcm) and 6.1% as LNG (17.8 bcm), thereby continuing to fund the Russian war effort.

Two important trends are visible: declining overall LNG consumption in the EU and the growing Russian share.

According to CREA analysis, with decreasing natural gas consumption in the EU and the rapid refilling of underground gas storage, the EU imported 14% less LNG in the first seven months of 2024 compared to 2023, and 7% less than in 2022 from all parts of the world. Significant reductions in LNG imports were observed from several countries: the US (-13%), Qatar (-22%), Nigeria (-36%), and other destinations (-23%).

However, Russia was the only country from which the EU’s LNG imports increased. During the first half of 2024, EU countries increased their imports of Russian LNG gas compared to the same period of 2023, even despite efforts to reduce fossil fuel dependence on Russia after the war began.

Recent measures targeting Russian LNG include a decision by the European Parliament on 11 April 2024 to implement an import ban on Russian LNG, allowing European Member States to exclude these imports. However, the mechanism for enforcing this ban has not yet been developed or established.

On 24 June 2024, the EU Council adopted the 14th package of sanctions against Russia over its war on Ukraine. This package aims to further weaken Putin’s regime and those supporting his illegal war.

While it significantly restricts Russian LNG, it nevertheless does not completely ban it.

The sanctions prohibit future investments in and exports to LNG projects under construction in Russia. After a nine-month transition period, the use of EU ports for the transshipment of Russian LNG will also be banned.

Despite these measures, Russia continues to generate substantial revenue from LNG sales to Europe. Russia has made it clear that it does not intend to limit its LNG sales to the European market.

In comes the war tax

To limit Russia’s profits from LNG and pipeline gas sales to the EU, ICUV experts recommend establishing an intermediary fiscal instrument: a war tax, in the form of customs duty at the EU level specifically targeting Russian LNG.

Customs duties are taxes imposed by governments on imported goods. Currently, Russian goods imported into the EU are taxed at the same rate as goods from any other non-preferential country, like China.

As of August 2024, no additional customs duties on Russian hydrocarbons are imposed at the EU level or by Member States beyond those covered by specific EU regulations.

The European regulatory framework for setting customs duties is governed by World Trade Organization (WTO) rules. Russia, as a WTO member, qualifies for Most Favored Nation (MFN) status, which ensures equal market access and guaranteed tariff reductions among WTO member countries. Although there is no procedural mechanism to expel Russia from the WTO, individual countries can withdraw MFN status from Russia under Article XXI of GATT, citing security concerns.

For certain Russian goods not covered by the import ban—such as LNG, LPG, pipeline gas, and certain oil-derived products—the EU could increase customs duties by amending the Common Customs Tariff and other necessary legislative measures at the EU level.

The funds collected through this war tax should be allocated to the EU budget, with money to be used to support Ukraine and therefore partially ease the burden on European taxpayers.

This is not a new instrument for the EU, as there is already a precedent for imposing additional customs duties on Russian agricultural products. For example, on 30 May, 2024, the EU Council adopted a decision to modify Annex I, increasing customs duties on imports of cereals, oilseeds, and derived products from Russia and Belarus.

Additional customs duties can be applied to those hydrocarbons that are not covered by an import ban via the following steps:

- A decision by the EU regarding the deprivation of Russia’s MFN regime.

- Decisions within the EU Customs Union regarding amendments to the Common Customs Tariff.

- Implementation on the border by collecting customs duties.

This measure is possibly the most straightforward and easy to implement from a legal point of view, the experts argue, as well as consistent with the existing practices of other countries.

The successful implementation of these measures is projected to generate additional revenues and serve as an incentive against further Russian attacks on Ukraine’s energy system.

Given the scale of the proceeds from the sales of Russian LNG to the EU, it is crucial to implement stringent measures aimed at minimizing these revenues and super-profits through appropriate actions – the war tax. The revenues thus secured, effectively sourced from Russia, should be directed as part of the financial compensation towards Ukraine, offering a tangible form of redress for the ongoing war.

This strategy not only aligns with international legal norms but also serves as a direct reinvestment of the aggressor’s funds into the recovery of the victim, thereby reinforcing the principles of justice and accountability within the EU’s broader policy framework.

Moreover, the introduction of the war tax can be set so that it is used as a preemptive measure against further escalations and renewed aggression. A step-up incremental increase of the rate of the war tax could be implemented. The revision/increase of the rate is to be directly linked to any future aggression and/or destruction of civilian and critical infrastructure, including energy infrastructure.

Intermediary measure against aggression

ICUV experts believe that implementing a war tax on Russian LNG would be a significant step toward weakening the Russian economy’s reliance on hydrocarbon revenues. While not a complete solution, it offers an intermediary measure to reduce Russia’s war profits and provide additional support to Ukraine. This approach balances the need to maintain energy security for EU member states while taking concrete action against Russian aggression.

The war tax proposal demonstrates a proactive stance in addressing the complex challenges posed by the Russo-Ukrainian War. By leveraging economic tools, the EU can exert pressure on Russia’s war economy while simultaneously generating funds for Ukraine’s defense and recovery efforts. This multifaceted approach aligns with broader international efforts to support Ukraine and hold Russia accountable for its actions.

As the situation continues to evolve, the flexibility of the war tax mechanism allows for adjustments based on changing circumstances. This adaptability ensures that the EU can respond effectively to new developments in the conflict while maintaining its commitment to Ukraine’s sovereignty and European security.

Related: